Avoiding the 7 Biggest Mistakes Traders Make: Tips for Success in the Market

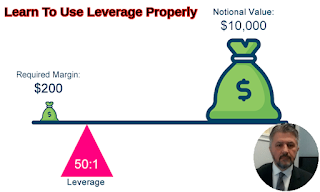

by: Ivan Cavric Trading can be a challenging and complex endeavor, and even the most experienced traders can make mistakes. Here are seven of the biggest mistakes traders make, and how you can avoid making them: Not having a trading plan: One of the most common mistakes traders make is not having a clear trading plan. A trading plan should include your goals, risk management strategy, and a detailed plan for how you will enter and exit trades. Without a trading plan, you are more likely to make impulsive decisions and be swayed by emotions. Not managing risk: Risk management is an essential part of trading, but many traders ignore it. Without a proper risk management strategy in place, you are more likely to suffer significant losses. It's important to have a plan in place for when things go wrong and to have a stop-loss in place to limit your losses. Over-leveraging: Leverage can be a powerful tool, but it can also be dangerous if not used correctly. Over-leveraging your trades...