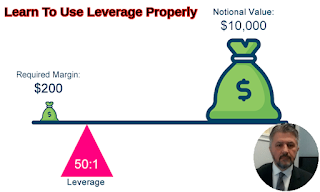

Learn To Use Leverage Properly

By: Ivan Cavric

As already stated, you will need to be able to use leverage in order to acquire worthwhile profits. However, you must proceed with caution because the poor utilization of leverage could expose your account balance to excessive levels of risk. For instance, some Forex Brokers offer leverage as high as 400:1. Although this sounds impressive and very desirable, you must appreciate how to exploit such a facility accurately before trying to use it in full earnest. Here are some important features about leverage that you must be fully aware of:

- Always remember that using larger levels of leverage also increases your risks significantly. It is important to monitor your account balance regularly and utilize stop-loss orders on all your open positions in order to restrict your risk exposure.

- Although using stops is good practice, you must still understand that you will increase your risk exposure significantly if you start leveraging in a recklessly manner.

Before you enter any trade know exactly how much you are risking with all of your trades. Very importantly, when you determine your risk exposure for each trade that you intend to open then you must base this calculation on your own account balance and not on your leverage facility. You may be surprised to know that many Forex novices use the latter and then wonder why they lose their equity so quickly.

For example, if you have $5,000 in equity and your Forex broker provides you with a 100:1 leverage facility then you will have a leveraged balance of $500,000. Consequently, if you use your own $5,000 to determine your risk per trade then you will be able to provide the optimum protection for equity. However, if you were to foolishly use your leveraged account of $500,000 for this purpose then you could expose your account to unsubstantiated levels of risk.

Suppose your money management policy sensibly advises that you should only risk 1% of your account per trade. However, you could still incur serious problems if you attempt to determine your risk exposure by utilizing your full leveraged facility to support this action. This is because you would risk $5,000 on just one trade. In other words, you will be gambling all your equity on one position! You must agree that such an action could be the equivalent of committing financial suicide.

You are well-advised that under no circumstances should you ever contemplate utilizing your leveraged account because you will eliminate any real possibilities of earning consistent Forex profits over the long haul by doing so. In fact, this is one of the main reasons why novices lose all their equity shortly after they commence their Forex trading careers. Fundamentally, they were using too much leverage per position which caused them to over trade. You can overcome this problem by developing a well-tested risk and money management strategy.

Click here and receive a free

e-book.

https://www.free-ebooks.net/ebook/Forex-Frontiers-The-Beginners-Booklet

Comments

Post a Comment