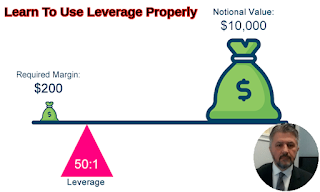

Learn To Use Leverage Properly

By: Ivan Cavric As already stated, you will need to be able to use leverage in order to acquire worthwhile profits. However, you must proceed with caution because the poor utilization of leverage could expose your account balance to excessive levels of risk. For instance, some Forex Brokers offer leverage as high as 400:1. Although this sounds impressive and very desirable, you must appreciate how to exploit such a facility accurately before trying to use it in full earnest. Here are some important features about leverage that you must be fully aware of: Always remember that using larger levels of leverage also increases your risks significantly. It is important to monitor your account balance regularly and utilize stop-loss orders on all your open positions in order to restrict your risk exposure. Although using stops is good practice, you must still understand that you will increase your risk exposure significantly if you start leveraging in a reckless...